Recently, PBGH held its 2022 Trends Forum. Our forum started with two breakout sessions, which included Dr. “Ned” Kusti, PBGH Medical Director, and Debbie Partsch, of Innovu, who reviewed the current state-of-affairs of Covid-19. Then Larry Thompson of Advanced Medical Pricing Solutions (AMPS) led the second breakout session. He discussed this year’s trends that will impact companies’ health benefit plans. For our special presentation that closed out the forum, Dr. Lindsay Sears of One Drop reviewed strategies around “Improving Employee Health, Engagement and Retention in 2022.”

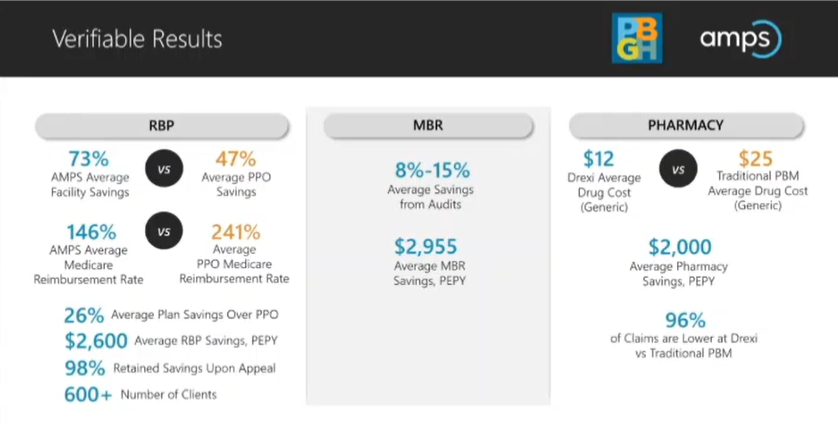

Larry Thompson started his presentation with the current environment of healthcare. The common theme is that, unfortunately, healthcare costs are continuously rising. Healthcare inflation has outpaced wage increases. Thirty-five percent of an average family’s take-home pay goes towards healthcare, and the average single coverage annual deductible has risen 13 percent in the last five years. This is a massive increase. Other factors contributing to the increase in healthcare spending include, surprisingly, errors on bills and, not so surprisingly, prescription drug expenditures. Over 90% of hospital bills contain errors. This accounts for about $900 billion in excessive costs. The United States spends more for drugs than any other top 10 OECD nation. They make up around 20 percent of the average employer health expenses. For example, in reviewing twenty name brand prescription drugs, the USA paid 200-400 percent more than Australia, Canada, and France. On top of that, specialty drugs account for more than half of the drug expense, yet only 2 percent of the U.S. population uses them.

Mr. Thompson expressed that the American healthcare system is best, he has lived in four different countries, but it needs to be better. Twenty-eight million people do not have healthcare coverage because of the costs and the system is spending way more than needed. This is why he stands behind AMPS. With their tools, they help create healthcare that can be more affordable for everyone.

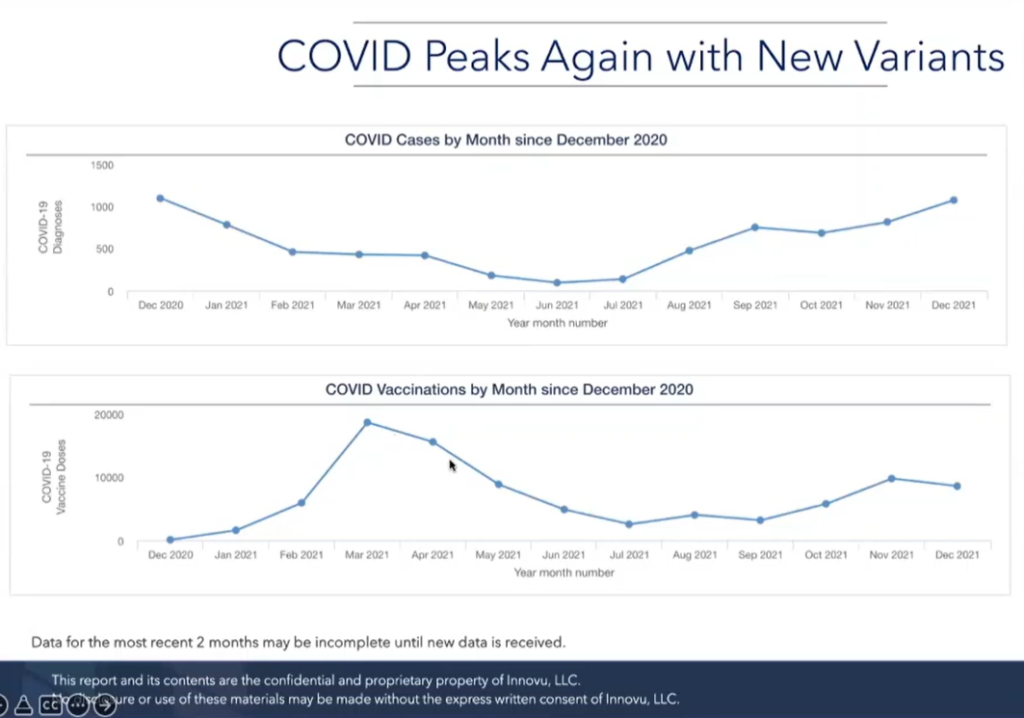

During the Covid-19 breakout session, Debbie Partsch (of Innovu) analyzed the current peaks of Covid against the vaccination rates. You can see in the graph, the increase of vaccinations in February of 2021 and then again in November of 2021. This is when the vaccination became widely available with a push in vaccination clinics in communities, and then when they received their boosters.

Ms. Partsch and Dr. Kusti both referenced the increase of use with at-home Covid-19 tests. Ms. Partsch wants employers to be aware that there is a new code for insurance to track these purchases. Plans must cover up to eight at-home tests per individual. Dr. Kutsi furthered the discussion of at-home test expense with reference to a prediction study one business did to determine how much these tests actually cost employers. Expenses could range from $150,000 to $1.5 million per month depending on the employee’s family size. This employer had to reconfigure their budget and is a good reminder that nothing is ever “free.”

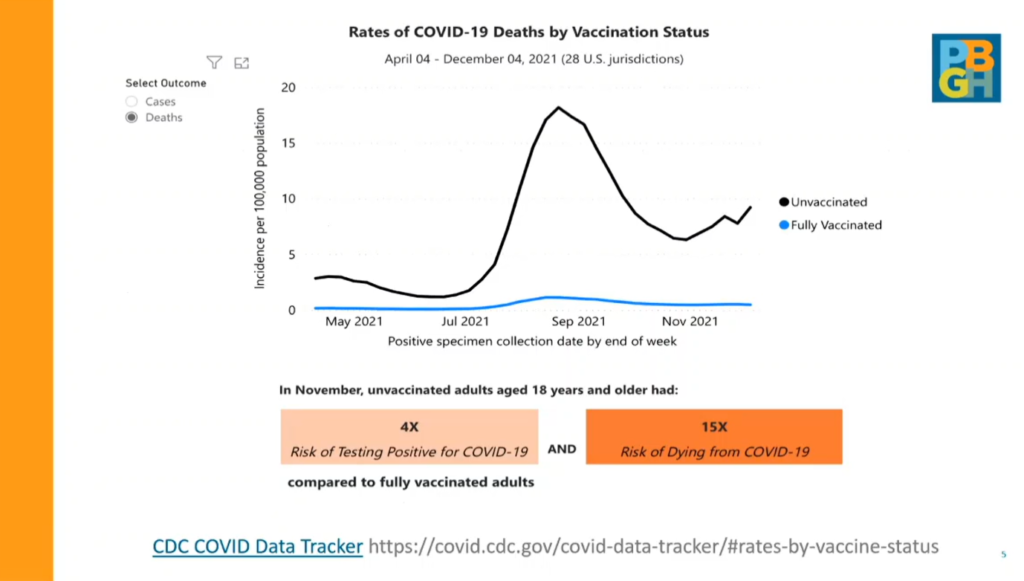

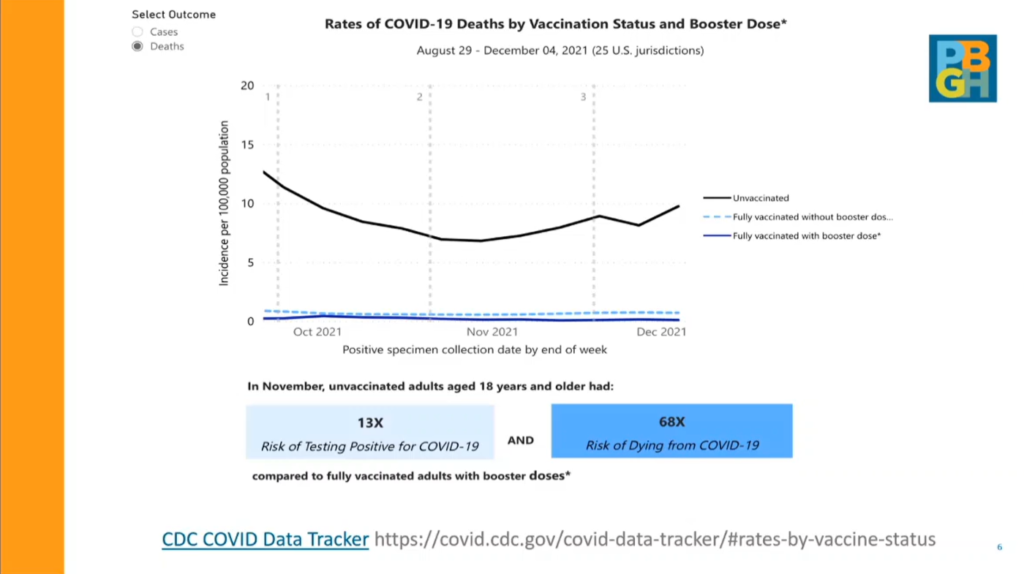

Dr. Kutsi showed that vaccinations are still proving to be the best line of defense against the Covid-19 virus, especially when you add the booster into the mix. The numbers are clear showing that there is a sixty-eight times greater risk of dying from Covid-19 if you are not vaccinated.

Dr. Lindsay Sears finished out the Trends Forum with a discussion around issues in keeping employees engaged, not feeling overloaded with work, and retention rates. This is especially difficult after two years of a pandemic. Add in a chronic illness, and it becomes even more challenging. One Drop performed a study to see the impact of the pandemic in people with Type-2 Diabetes. The results showed that:

- 94% reported negative life impacts

- 63% reported missed or delayed preventative appointments

- 76% reported impacts on diabetes-related health behaviors

Many of the same factors associated with burnout are associated with employee retention challenges. These include feeling overloaded with work, lack of support, control and clarity, and recurring stressors with little opportunity to recover. Solutions revolve around the idea of a healthy and fair work environment, professional development, and competitive health insurance packages and pay.

Digital health options, like One Drop, is a key solution in curbing these challenges. One Drop members feel they can better manage their illness, improving their self-efficacy and helps with their productivity on the job. Simply put, One Drop lets its members live a happier life, and gives them a better quality of life. Having this option available for your employees builds loyalty, too.

The common thread that came up in all three presentations was that the communities of color and lower income are affected the most. This is something we cannot let go unnoticed. PBGH is striving to bring awareness to this critical issue. Please visit our Bridges 4 Health Equity page, our Health Equity Series page, and consider taking our Equity Pledge Challenge.

Post a Comment